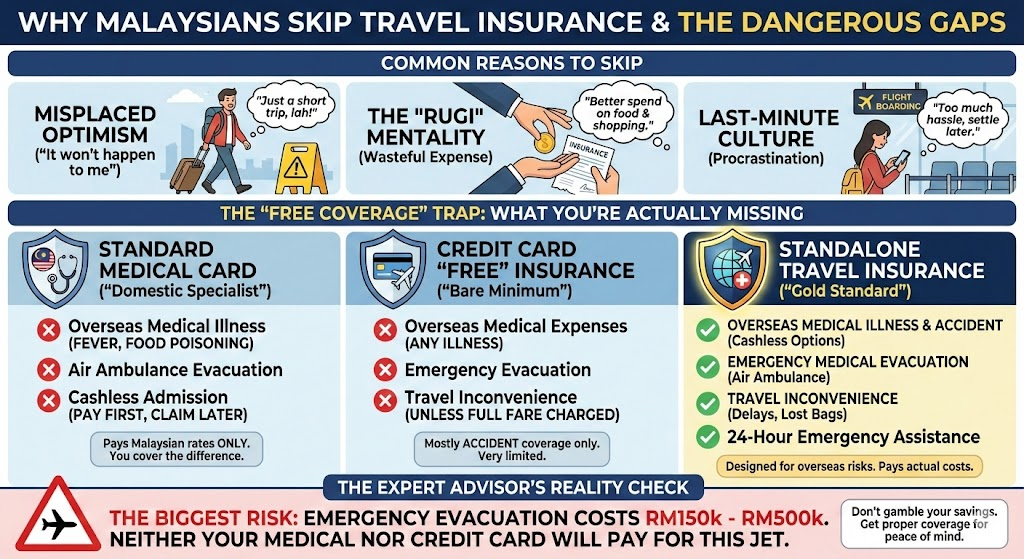

As an insurance advisor who has walked many Malaysians through the “what-ifs” of travel, I can tell you the resistance usually boils down to three main factors: misplaced optimism, coverage confusion, and the “rugi” (wasteful) mentality.

First, there is a pervasive “it won’t happen to me” mindset. Many Malaysians view travel insurance as an unnecessary “tax” on their holiday budget rather than a safety net. When budgeting for a trip, they prioritize tangible experiences—shopping, food, and accommodation. Spending RM50 to RM100 on a piece of paper that they hope never to use feels like a loss (or “rugi”) right from the start. This is especially true for short, regional trips to places like Hatyai, Singapore, or Bali, where the proximity to home creates a false sense of security. They assume that if something goes wrong, they can just “tahan” (endure) until they get back to Malaysia.

Second, there is a dangerous reliance on “free” or existing coverage. A large number of travelers mistakenly believe their standard medical card covers them overseas. In reality, most Malaysian medical cards only cover hospital admissions within Malaysia; overseas coverage is often limited to specific accidental emergencies or requires you to pay first and claim later (which can cost tens of thousands upfront). Similarly, many rely on the “free travel insurance” provided by their credit cards. They don’t realize that these policies are typically travel accident policies (paying out only for death or permanent disability) or inconvenience benefits (flight delays), completely excluding the most critical component: overseas medical expenses for illnesses like food poisoning or high fevers.

Finally, we have the “last-minute” culture. Insurance is often an afterthought, something to be sorted out at the airport or while waiting for the Grab ride. By then, the hassle of filling out forms or the fear of navigating a complex website discourages them. This procrastination also leads to a secondary issue: buying insurance after the trip has technically begun or too late to cover pre-departure cancellations. Ultimately, many skip it simply because the process feels like administrative homework during a time when they just want to relax.

Travel Insurance Benefits at a Glance:

I had thought that medical cards cover overseas treatments, is this not the case?

This is one of the most dangerous assumptions I see my clients make, and it’s a classic case of “Technically Yes, Practically No.”

If you read your policy contract deeply, you might see a clause about “Overseas Treatment.” However, relying on this for a holiday is risky for three very specific reasons that most agents won’t highlight until you try to make a claim.

1. The “Reasonable & Customary” Trap

Most medical cards have a clause stating they will only cover overseas costs up to what is “Reasonable and Customary” in Malaysia.

- Scenario: You get appendicitis in Singapore or the US.

- The Cost: The surgery there might cost RM80,000 (converted).

- The Claim: Your Malaysian insurer looks at the bill and says, “This surgery only costs RM20,000 in a private hospital in Kuala Lumpur. We will reimburse you RM20,000.”

- The Result: You are forced to pay the remaining RM60,000 out of your own pocket. (Here’s the thing though: not many of us can easily fork out RM 60,000 for a medical treatment overseas.)

2. It is almost always “Pay First, Claim Later”

In Malaysia, you are used to flashing your medical card for a “Cashless Admission”—the hospital talks to the insurer, issues a Guarantee Letter (GL), and you get treated.

Overseas, your medical card has no power. Foreign hospitals do not recognize Malaysian medical cards. If you are admitted, you must pay the full bill (often tens of thousands of dollars) on your credit card or via wire transfer before you are discharged. You then have to bring the documents back to Malaysia, translate them, submit them, and wait 1–3 months for reimbursement.

Travel insurance (specifically the comprehensive ones) is different; for large hospital bills, many insurers have a 24-hour hotline that can arrange a Guarantee Letter with the foreign hospital directly, saving your cash flow.

3. “Emergency Only” vs. “Illness”

We need to look at your policies closely to find out what is covered by a medical card overseas. Standard medical cards often strictly define overseas coverage for Accidental Emergency only, or they exclude “Outpatient” treatment entirely.

- Medical Card: If you get severe food poisoning in Bangkok and need an IV drip at a clinic (Outpatient), your Malaysian medical card usually pays RM0.

- Travel Insurance: This is fully covered as “Medical Expenses,” often with a limit of RM300,000 or more.

Summary

Your medical card is designed to pay Malaysian rates in Malaysian hospitals. Using it overseas is like trying to use a Touch ‘n Go card on the London Underground—it might look like a travel card, but the system won’t accept it. Even if you’re able to claim it after you have come back to Malaysia, the problem lies in:

- Pay first and claim later.

- Covers Malaysia’s standard treatment costs only. Foreign hospitals usually cost more than Malaysian private hospitals.

I always use this chart to show clients exactly where their financial exposure lies if they rely solely on their credit card or medical card.

| Feature | Standalone Travel Insurance (The “Gold Standard”) | Standard Medical Card | Credit Card Free Insurance (The “Bare Minimum”) |

| Medical Expenses (Illness) | Fully Covered. Covers high fevers, food poisoning, flu, etc. | Usually NOT Covered. Most cards only cover accidental injuries overseas, not illnesses. | NOT Covered. Strictly for accidents only. If you get Dengue, you pay $0. |

| Payment Method | Cashless Admission (Often). Insurers can issue a Guarantee Letter (GL) for large bills. | Pay First, Claim Later. You must settle the full bill yourself, then claim reimbursement in Malaysia. | Pay First, Claim Later. Reimbursement is often slow and heavily scrutinized. |

| Billing Limit | Actual Cost Charged. Pays the foreign hospital’s actual rates (up to your limit). | Reasonable & Customary. Only pays what the procedure would have cost in Malaysia. You pay the difference. | N/A (Rarely covers medical costs). |

| Emergency Evacuation | Fully Covered. Will pay for an air ambulance to fly you home (cost can exceed RM300k). | Rarely Covered. If covered, usually has a very low cap (e.g., RM50k). | NOT Covered. You are stranded if you cannot afford the flight home. |

| Travel Inconvenience | Covered. Pays for flight delays, lost luggage, missed connections. | NOT Covered. Strictly for medical issues. | Limited Coverage. Usually requires you to have charged the full flight ticket to that specific card. |

| Outpatient Treatment | Covered. Pays for clinic visits (e.g., stitches, meds, consultation). | NOT Covered. Usually requires hospital admission (overnight stay) to be claimable. | NOT Covered. |

If you look at the “Emergency Evacuation” row, that is the single biggest reason to buy travel insurance.

If you suffer a stroke or a severe fracture in a remote area (like a hiking trail in Vietnam or a ski slope in Japan), a commercial flight cannot take you home. You need an Air Ambulance. This costs between RM150,000 to RM500,000 depending on the distance.

- Medical Card: Won’t pay for the jet.

- Credit Card: Won’t pay for the jet.

- Travel Insurance: Pays for the jet, the medical team on board, and the coordination.

Under what circumstances that a medical card can replace a travel insurance?

While I often warn against relying on it, there are specific scenarios where a medical card can technically “replace” the medical portion of travel insurance. However, these are rare and usually apply to premium policyholders or specific demographics.

Here are the only circumstances where your medical card might be enough:

1. You Hold a “Global” or “International Exclusive” Policy

Standard medical cards are “Malaysia-Only.” However, high-net-worth individuals often buy International Medical Cards (e.g., from insurers like Allianz, Cigna, or specialized “Prestige” plans from local insurers).

- The Scenario: You pay a significantly higher premium (often RM12,000+ per year) for a card that explicitly states “Area of Coverage: Worldwide.”

- The Result: These cards often offer cashless admission overseas and high annual limits (e.g., USD 1 Million). In this specific case, your medical coverage is actually better than travel insurance because it covers pre-existing conditions (after a waiting period) and long-term cancer treatments abroad, which travel insurance excludes.

2. You Are Travelling to Singapore or Brunei (For Specific Plans)

Because of the high volume of cross-border commute, some Malaysian medical cards have a “Reciprocal Arrangement” clause.

- The Scenario: Your policy explicitly lists Singapore and Brunei as “Domestic” for the purpose of coverage, or allows for treatment there without penalty if it is an emergency.

- The Caveat: You must check if the “Reasonable & Customary” clause still applies. If a Singapore hospital charges 3x the Malaysian rate, your insurer might still only pay the Malaysian equivalent unless you have a specific rider.

3. You Are a Student Studying Abroad (With a Student Rider)

If you are a parent asking for your child who is studying in the UK or Australia:

- The Scenario: You have attached a specific “Overseas Student Rider” to their existing medical card.

- The Result: These riders effectively convert a local card into an international one for the duration of the study years. They often cover outpatient clinic visits and hospitalizations abroad. However, they usually do not cover “leisure travel” to a third country (e.g., if the student goes from London to Paris for a weekend).

4. You Have “Deep Pockets” and Only Fear “Death/Disability”

This is not about the policy replacing travel insurance, but your financial status replacing the need for it.

- The Scenario: You have a credit card with a RM100,000+ limit to settle hospital bills upfront (Pay First), and you don’t care about “small” losses like lost luggage, flight delays, or a RM3,000 outpatient bill.

- The Reality: You are relying on the “Emergency Assistance” benefit in your medical card. Most standard cards do cover “Emergency Accidental Outpatient” and “Emergency Sickness” abroad, but on a reimbursement basis. If you are wealthy enough to float the cash and handle the paperwork later, you might feel you don’t need a separate RM80 travel policy.

Even in these four scenarios, a medical card never replaces the Travel Inconvenience benefits.

- If your luggage is stolen in Paris? Medical card pays RM0.

- If your flight to Tokyo is delayed 12 hours? Medical card pays RM0.

- If you accidentally break a vase in a hotel lobby and they sue you (Personal Liability)? Medical card pays RM0.

Recommendation: Even if you have a Global Medical Card, I still advise clients to buy a cheap “Lite” travel insurance plan just to cover the flights, bags, and liability. It costs the price of a coffee compared to the risk.

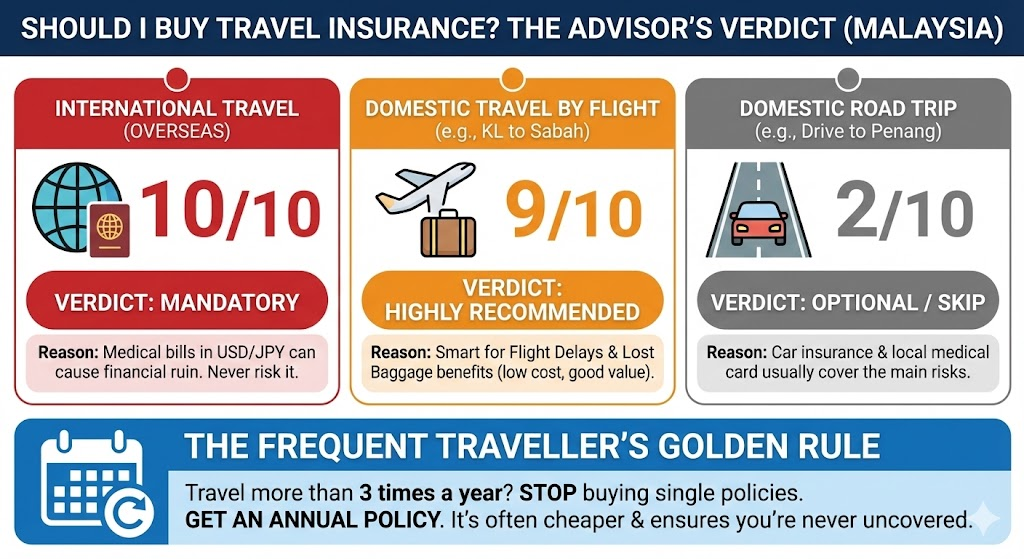

How Many Times out of Ten Times Should I Buy Travel Insurance?

Scenario A: International Travel (Overseas)

Score: 10 out of 10 Verdict: Mandatory. You should never cross the Malaysian border without it. The potential financial ruin from a single medical emergency overseas far far outweighs the RM50–RM100 cost of the policy for the duration of your international trip. It is simply not a gamble worth taking.

- If you can afford the flight ticket, you can afford the insurance. Just at the very least buy an essential/lite plan that’s the price of 1 coffee per day.

Scenario B: Domestic Travel by Flight (e.g., KL to Sabah/Sarawak)

Score: 9 out of 10 Verdict: Highly Recommended. While your medical card covers you in Sabah/Sarawak, you are buying this for the Inconvenience Benefits.

- Flights to East Malaysia are prone to delays due to weather.

- Luggage gets lost or damaged.

- For a premium of roughly RM15–RM25, getting paid RM200 for a delay or getting your lost bag covered is excellent value. I almost always buy it for these trips.

Scenario C: Domestic Road Trip (e.g., Driving to Penang/Melaka)

Score: 2 out of 10 Verdict: Optional / Skip. If you are driving your own car:

- Your Car Insurance covers the vehicle and towing.

- Your Medical Card (or government hospitals) covers any medical problems.

- You don’t have “flight delays” or “lost luggage.”

- Exception: I would only raise this score to 5/10 if you have pre-booked very expensive, non-refundable hotels or theme park tickets that you want to protect against cancellation.

The “Golden Rule” for Frequent Travelers

If you travel more than 3 times a year (internationally), stop buying single-trip policies.

Buy an Annual Travel Policy instead. It costs roughly RM300–RM400 a year. It covers you for unlimited trips (usually up to 90 days per trip) all year round. It saves you money and, more importantly, it saves you from forgetting to buy it.