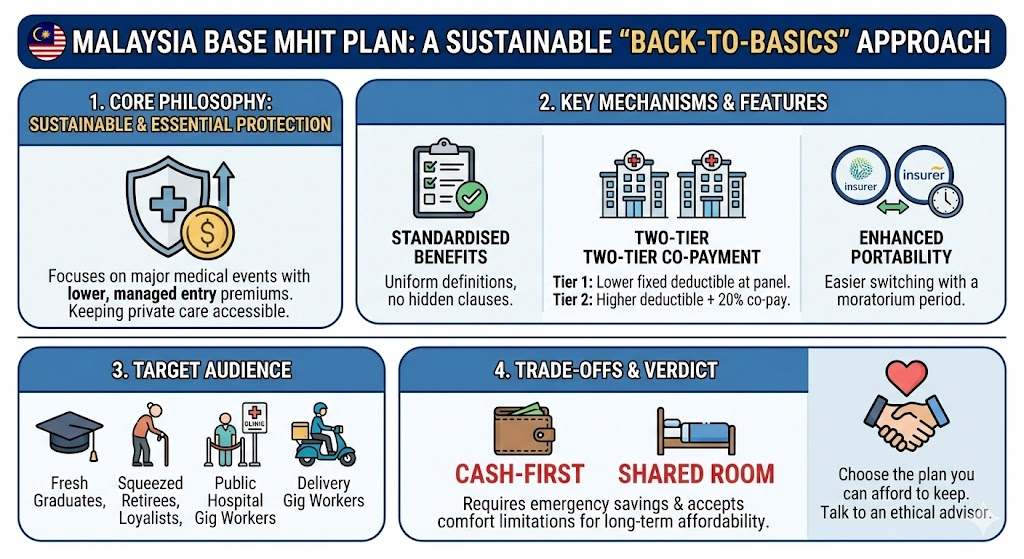

In my decades of helping Malaysians navigate the complex world of insurance—sitting across from thousands of you at kitchen tables and coffee shops, often having difficult conversations about rising premiums and medical inflation—I have rarely seen a regulatory development as significant as the recently announced “Base MHIT Plan” by Bank Negara Malaysia. For years, the number one grievance I’ve heard from my long-time clients isn’t about the quality of care, but the sustainability of paying for it; many of you have worried that your medical cards might one day become a luxury you can no longer afford. That is why this new initiative, detailed in BNM’s latest White Paper, feels like a pivotal moment: a government-backed push to introduce a standardised, “back-to-basics” medical insurance tier designed specifically to keep private healthcare accessible and affordable for the rakyat who need it most.

Let’s get real about what this plan actually is. For years, I’ve seen clients chasing “unlimited” lifetime limits and VIP hospital suites, only to be shocked when their repricing letters arrive with a 40% hike. The Base MHIT Plan flips this script. It is a standardised, no-frills contract designed to cover the essentials rather than the luxuries—offering a RM100,000 annual limit (which rightfully bumps up to RM150,000 if you are over 60) that is statistically sufficient to cover 99% of the hospital admissions I handle. But the game-changer here—and the part that might need some getting used to—is the cost-sharing structure. Yes, it introduces a deductible (starting at RM500 per disability), but this is the necessary trade-off for a premium that doesn’t skyrocket every time you blink. It is the regulator’s way of saying we need to share the responsibility if we want private healthcare to remain an option for the average Malaysian family, and frankly, it is a wake-up call the industry desperately needed.

One of the most heartbreaking things I face as an advisor is telling a loyal client, “I can’t move you to a cheaper plan because you had high blood pressure diagnosed five years ago.” You feel trapped, held hostage by your own health history while your premiums climb year after year. This is where the Base MHIT Plan offers a genuine lifeline: Portability.

For the first time, we are seeing a structural push to let you switch providers for this specific plan without the fear of total rejection. Instead of the grueling full medical underwriting we are used to, the framework introduces a “moratorium” period—essentially a waiting period (often 12 months)—during which pre-existing conditions aren’t covered, but after which, they are fully accepted. This effectively breaks the “lock-in” effect that has kept so many of you paying for bloated policies simply because you were too scared to leave. It forces insurers to finally compete on service and efficiency, rather than just banking on your fear of losing coverage.

| Feature | Waiting Period | Moratorium Period |

| What it blocks | New illnesses (Flu, Dengue, etc.) | Old illnesses (Pre-existing conditions) |

| Duration | Short (30 – 120 days) | Long (1 – 2 years) |

| Goal | Stop “last-minute” buying | Allow “uninsurable” people to enter the system |

The Moratorium Period (The “Pre-Existing Condition” Rule)

- What it is: A longer period specifically targeting health issues you already had before joining the plan.

- Purpose: To allow people with pre-existing conditions to get coverage eventually, without facing an outright rejection or a permanent exclusion.

- How it works in MHIT Portability:

- Instead of saying “You have high blood pressure, so we will never cover your heart,” the insurer says: “We will accept you, but for the first 12–24 months (the moratorium), we won’t pay for anything related to your blood pressure.”

- The Reward: If you survive that period without making a claim for it (or sometimes if you remain symptom-free, depending on the specific clause), the condition becomes fully covered after the moratorium ends.

- Key Point: This is the magic key for switching insurers. It replaces the permanent “Exclusion” sticker with a temporary “Wait-and-See” sticker.

Now, let’s talk about the elephant in the room—the price tag. For years, I’ve watched clients in their 30s pay reasonable rates, only to panic when they hit 60 and their premiums triple overnight. The Base MHIT Plan attempts to flatten this terrifying curve.

According to the White Paper, we are looking at indicative premiums that are significantly friendlier to the average wallet: for a standard plan with a RM500 deductible, a 30-something might pay between RM80 to RM120 a month—a far cry from the RM200+ distinct riders many of you are currently servicing.

But the real relief comes for my older clients. If you are willing to take on a higher deductible (the “Standard Plus” option with a RM10,000 threshold), premiums for those aged 61-65 could drop to around RM220–RM280 a month. While this isn’t “cheap” in absolute terms, compared to the RM600 or RM800 monthly bills I often see for private senior coverage, it is a game-changer that keeps coverage active when you need it most.

Just remember: these premiums are still risk-rated based on age and health status—this isn’t social welfare—but the hikes are designed to be gradual and monitored by the authorities, preventing the sudden “price shocks” that cause so many policies to lapse today.

Two Tier Co-Payment

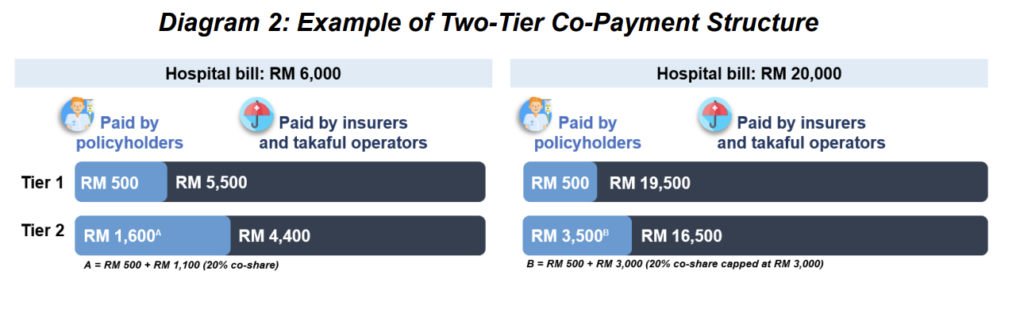

Now, let’s unpack the jargon that has half my clients scratching their heads: the “Two-Tier Co-payment” mechanism. This isn’t about your income tier; it’s about where you choose to get treated. In the past, your medical card was like a blank cheque—you could walk into almost any specialist hospital and the insurer just paid the bill. The Base MHIT Plan changes the rules to stop hospitals from overcharging.

Here is how I explain it to my clients:

- Tier 1 (In-Network): If you go to a hospital that is on the insurer’s “preferred” list (meaning they have agreed to fair, transparent pricing), you get the “friendly” rate. You pay your fixed deductible (e.g., RM500), and the insurer pays 100% of the rest. No hidden percentages, no nasty surprises.

- Tier 2 (Out-of-Network): If you insist on going to a non-panel hospital—maybe a specific celebrity surgeon or a luxury facility that refuses to agree to the standard rates—you can still go, but it will cost you. You pay your deductible, PLUS a 20% co-payment of the bill (capped at RM3,000 per disability).

From where I sit, this is actually a brilliant move. It doesn’t strip away your freedom of choice—you can still go to that fancy non-panel hospital if you really want to—but it puts a price tag on that luxury. More importantly, it forces hospitals to compete to get on that “Tier 1” list, which is the only way we are ever going to see medical inflation slow down in this country.

If I were to sit down with you and distill the hundreds of pages of technical jargon into the real-world advantages for you and your family, the biggest benefit of the Base MHIT Plan isn’t just the lower price tag—it is Simplicity and Sustainability.

For decades, the insurance market has been an “arms race” of confusing features—one company launches a “100-year” card, the next launches “unlimited,” and suddenly you are paying for bells and whistles that inflate your premiums but don’t actually improve your survival odds. This plan stops that madness. By standardizing the benefits (standard definitions, standard exclusions), it eliminates the “gotcha” clauses in the fine print. Whether you buy from Insurer A or Insurer B, a “heart attack” means the same thing, and the claim process is uniform.

Furthermore, this plan refocuses your coverage on what actually matters: Catastrophic Protection. It cuts out the “fat”—the fancy wellness apps, the outpatient fever claims, the unnecessary perks—that drive up costs for everyone. It ensures that your premium dollars are reserved strictly for the events that could bankrupt you, like a major surgery or long-term cancer treatment. It returns insurance to its original, noble purpose: a sturdy safety net for disasters, not a prepaid debit card for minor inconveniences.

Cons & Disadvantages of Base MHIT Plan by Bank Negara 2027

Now, I wouldn’t be doing my job if I didn’t sit you down and have a frank conversation about the trade-offs. As much as I support the philosophy behind the Base MHIT Plan, it is absolutely not for everyone, and signing up without understanding the fine print could leave you feeling shortchanged when you are lying in a hospital bed.

The biggest hurdle for most of my clients will be the “Cash-First” Mentality. For the last twenty years, Malaysians have been spoiled by “cashless” admission cards where you pay absolutely nothing. With this plan, you must have emergency savings. If you choose the higher deductible option to save on premiums, you might need to fork out RM10,000 upfront before the insurance pays a single sen. If your cash flow is tight, a “cheap” premium becomes very expensive the moment you get sick.

Secondly, we have to talk about that Annual Limit. While RM100,000 covers the vast majority of cases today, medical inflation in Malaysia is currently running at about 12-15% a year. What looks like a safe limit today might look dangerously thin in five or ten years. If you are unfortunate enough to suffer a complex illness—like a late-stage cancer requiring immunotherapy or multiple surgeries—that RM100,000 ceiling is going to feel very low, very fast. Unlike the “RM1 Million Annual Limit” cards I usually recommend for total peace of mind, this plan leaves a distinct gap for catastrophic, worst-case scenarios.

Finally, you have to accept a Loss of “VIP” Status. This plan is designed for healthcare, not comfort. You will likely be restricted to multi-bedded rooms (4-bedded or similar) rather than that private single room with the nice view. And with the Tier 2 co-payment penalty we discussed, your freedom to chase specific “star doctors” at premium, non-panel hospitals is heavily penalized. If you are the type of person who expects a hotel-like experience and absolute freedom of choice when you are ill, this plan will feel restrictive.

Who is this MHIT Base Plan by BNM for?

In my professional opinion, the Base MHIT Plan isn’t a “one-size-fits-all” solution. It is a strategic tool designed for specific groups of Malaysians. Based on the hundreds of profiles I’ve reviewed over the years, here is exactly who should be signing up:

1. The “First-Timer” & Fresh Graduate If you are 24 years old, just started your first job, and your take-home pay is barely covering rent and PTPTN, this is your entry ticket. I often see young people skip insurance entirely because a comprehensive card costs RM200+ a month. The Base MHIT Plan gets you into the private system for the price of a few cafe lattes. It protects your future insurability without breaking your monthly budget.

2. The “Squeezed” Retiree This is the group I am most concerned about. I have clients in their 60s who are facing 50% premium hikes on their old luxury plans and are seriously considering cancelling their policies entirely. Do not cancel. This plan is your lifeline. Yes, you lose the single room and the zero-deductible comfort, but trading down to a Base MHIT plan is infinitely better than being left with zero coverage at the age when you need it most. It allows you to keep a safety net for major surgeries without draining your retirement savings on monthly premiums.

3. The “Public Hospital” Loyalist (Who Wants a Backup) I meet many people who say, “I’m happy with government hospitals; the care is good.” And they are right—our public healthcare is excellent. But the queues are not. If you are generally content with public healthcare but want an affordable “backup key” to unlock private speed for urgent surgeries (like an appendix removal or a minor fracture repair), this plan is perfect. It sits in your drawer costing very little, ready to be used only when the public waiting list is too long.

4. The Gig Worker & Freelancer If you drive for Grab, do freelance design, or run a roadside stall, you don’t have an HR department covering your medical bills. Your income fluctuates. You need a plan that is lean and predictable. The Base MHIT plan gives you that “catastrophic cover”—ensuring that a sudden illness doesn’t wipe out your hard-earned savings or force you to sell your assets—without the heavy fixed cost of a premium plan.

Who is this NOT for? If you view insurance as a luxury service—if you expect a private suite, want to choose your celebrity doctor at Gleneagles or Prince Court without penalty, and want to walk out of the hospital without paying a single sen—do not buy this plan. You will be frustrated by the deductibles and the room limitations. Stick to the comprehensive riders and pay the premium that lifestyle demands.

How does this affect insurance agents?

This is the part of the conversation that usually happens in hushed tones during agency meetings, but since we are being transparent here, I’m going to pull back the curtain on how this affects the people selling you the policies—the agents.

If you are wondering, “If this plan is so good, why hasn’t my agent pitched it to me yet?” the answer often comes down to simple economics: Commission Compression.

In the insurance world, an agent’s income is tied directly to the premium you pay. A “Standard” MHIT plan with a premium of RM100 a month generates significantly less commission than a comprehensive rider costing RM300 a month. For many agents, especially those relying on high-margin products to survive, the Base MHIT Plan is a financial threat. It requires us to do the same amount of work—the paperwork, the explanation, the claims assistance—for a fraction of the pay.

Furthermore, there is a genuine fear of “Cannibalization” in the industry. Agents are worried that existing clients—people like you who currently pay for premium “full-service” cards—will decide to downgrade to this cheaper Base plan to save money. If that happens en masse, agency incomes could plummet overnight. This creates a conflict of interest where some advisors might downplay the Base MHIT plan or highlight its flaws (like the deductible) just to keep you on the more expensive legacy products.

However, for the ethical, forward-thinking advisor, this plan is actually a blessing in disguise. It opens the door to a huge segment of Malaysians who were previously “uninsurable” due to cost. It allows us to build a relationship with a fresh graduate or a gig worker today, get them covered with the basics, and then grow with them as their income rises. It shifts our role from being “product pushers” to being true financial planners—helping you mix and match a Base plan for catastrophe cover with other instruments for income replacement or retirement.

Ultimately, this plan might mark the beginning of a split in the industry: “Order-Taker” agents who disappear because they can’t survive on the lower margins, and “Professional Advisors” who survive by offering you genuine advice, regardless of the commission size.

So, where do we leave things? If you take one thing away from my years of watching policies lapse and premiums soar, let it be this: The best insurance policy is the one you can actually afford to keep long-term.

My final challenge to you is simple. Dig out that policy document you haven’t looked at in years. If you are uninsured, or if you are staring at a premium notice that makes your stomach churn, do not ignore it. Call your advisor—or find a new one—and ask them point-blank: “Is the Base MHIT Plan a viable option for my situation?” If they try to brush it off or immediately pivot to a more expensive product without hearing you out, that is your red flag. We are entering a new era of healthcare in Malaysia, one where we have to choose between luxury and sustainability. I hope you choose the one that keeps you protected when it matters most.

Summary: The Pros and Cons of the Base MHIT Plan

This table is designed to give you a quick, balanced overview of the trade-offs involved in choosing this “back-to-basics” coverage.

| The Pros (The Good News) | The Cons (The Hard Truths & Trade-Offs) |

| Significantly Lower Premiums Entry costs are drastically cheaper than current comprehensive riders (e.g., est. RM80-RM120/month for young adults), making private coverage accessible. | Requires Upfront “Cash-First” Payment You must have emergency savings ready to pay the fixed deductible (e.g., RM500 or higher) before insurance kicks in. |

| Sustainable Long-Term Costs Designed to flatten the “premium inflation curve,” preventing the massive price shocks currently seen by older policyholders. | Annual Limit Ceiling (RM100k) While sufficient for most cases today, the RM100,000 limit (RM150k for seniors) may become inadequate for complex, long-term illnesses due to future medical inflation. |

| Enhanced Portability (Breaking the Lock-In) Allows switching between insurers without full medical re-underwriting, using a “moratorium period” for pre-existing conditions instead of outright rejection. | Loss of VIP Comfort & Luxury Coverage is typically restricted to multi-bedded rooms. No private suites or luxury hospital experiences. |

| Standardised Definitions Benefits and exclusions are uniform across all insurers. No hidden clauses or confusing variations in fine print between companies. | Financial Penalty for Non-Panel Choice Choosing a Tier 2 (non-panel/premium) hospital incurs an additional 20% co-payment on top of your deductible. |

| Catastrophic Focus Premium dollars are efficiently directed toward major, bank-breaking events (surgeries, cancer), cutting out expensive “frills” like wellness apps or outpatient perks. | No “Frills” or Extras Does not cover outpatient GP visits, wellness programs, or other ancillary benefits common in premium cards. |

| 100% Coverage at Panel Hospitals (Post-Deductible) Once you pay your fixed deductible at a Tier 1 panel hospital, the insurer pays the rest of the eligible bill in full. | Potential Agent Reluctance Due to lower commissions, some agents may not proactively offer this plan or may highlight its downsides aggressively. |