Searching for an AIA medical card online often feels like stumbling into a maze of insurance jargon. When you Google “AIA medical card” and eagerly click on the first search result, you expect a straightforward answer but are instead greeted by an overwhelming product listing page packed with confusing options. Between “A-Life MediFlex,” “A-Plus Health 2,” and their various “-i” Takaful equivalents, the sheer volume of plans makes it impossible to figure out where to start. You are immediately bombarded with buzzwords like “Health Wallets,” “SMART Options,” “deductibles,” and “Vitality boosters” without any simple, side-by-side guidance to tell you which card actually fits your specific budget or stage of life. Frustrated by the labyrinth of marketing fluff and dense policy brochures, it’s incredibly common to just close the tab and leave the website having learned absolutely nothing about which medical card you should actually choose.

Navigating the world of medical insurance can often feel like deciphering a foreign language, especially when faced with a maze of complex policy names, tiered benefits, and dense industry jargon. Recognizing how overwhelming it is to choose the right coverage from AIA’s extensive lineup of Conventional and Takaful plans, I created this page with a single, dedicated goal: to break down these medical card products into clear, simple, and easily digestible information. By stripping away the marketing fluff and organizing the options logically, my aim is to empower you to confidently compare benefits, understand exactly what you are paying for, and ultimately select the perfect plan that protects your health and budget without the usual headache.

I have dedicated countless hours to meticulously reading through every AIA medical card brochure and comprehensively analyzing all the intricate details available on their website so that you don’t have to. This project is the culmination of extensive research, representing a significant investment of time and effort aimed at decoding complex insurance jargon and untangling the nuanced differences between each policy. My ultimate goal in devouring all this dense material is to translate it into clear, straightforward insights, ensuring that you, my valued customer, can make a confident and fully informed decision about your healthcare coverage without the stress of navigating that overwhelming maze of options on your own.

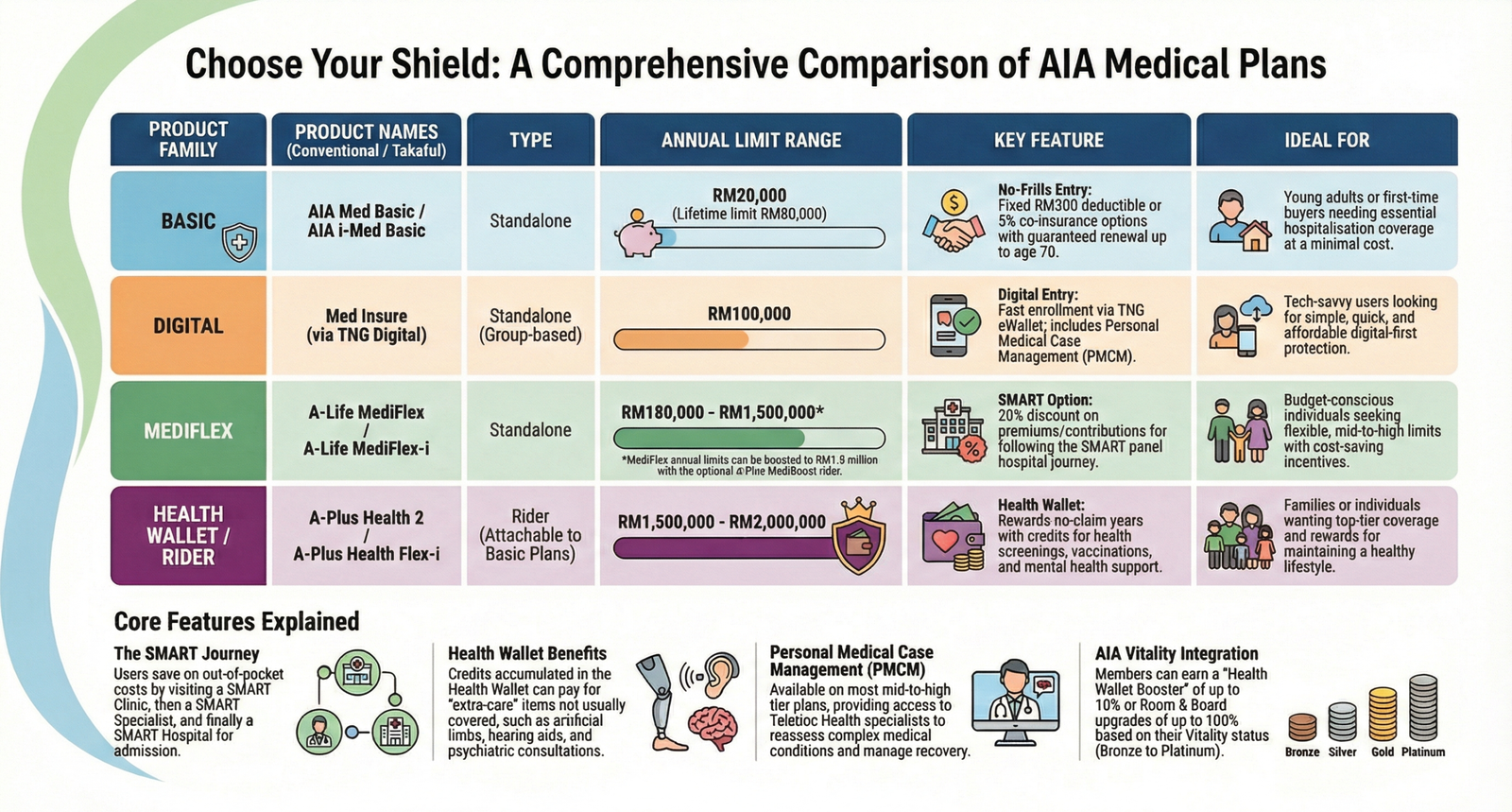

To make this process as easy as possible, I have organized AIA’s medical cards into four distinct, easy-to-understand tiers: Basic, Digital, Flexible, and Premium. Below, you will find a straightforward, side-by-side breakdown that highlights exactly what matters most—like annual limits, hospital room allowances, and unique cost-saving features—without the confusing industry speak. Simply identify which tier best matches your current stage of life and budget, and you will be well on your way to securing the right healthcare protection with absolute confidence. Let’s dive into the comparisons and find your perfect fit.

Here is a comparison table that breaks down the key features, limits, and cost-saving options of the AIA medical cards based on the provided brochures.

| Feature | AIA Med Basic & i-Med Basic | TNGD-AIA Med Insure | A-Life MediFlex & MediFlex-i | A-Plus Health 2 & Health Flex-i |

|---|---|---|---|---|

| Product Type | Basic Medical Insurance / Takaful | Digital Medical Insurance via Touch ‘n Go eWallet | Mid-Tier Flexible Medical Insurance / Takaful | Premium Comprehensive Medical Insurance / Takaful |

| Best Suited For (Target Customer) | The Budget-Conscious / First-Timer: Ideal for young adults, students, or lower-income earners who want pure, affordable, no-frills protection just in case of hospitalization. | The Tech-Savvy / Gig Worker: Perfect for freelancers or those supplementing company insurance who want higher coverage but are willing to pay a deductible to keep premiums low. | The Smart Saver / Family: Great for cost-conscious individuals or families who want high coverage limits and are willing to use a specific hospital network to get a 20%+ discount on premiums. | The Value Seeker / High-Earner: Best for those who want maximum peace of mind, very high limits, and want to be actively rewarded (via the Health Wallet) for staying out of the hospital. |

| Annual Limit | RM20,000 | RM100,000 | RM180,000, RM250,000, or RM350,000 | Up to RM2,000,000 |

| Lifetime Limit | RM80,000 | No Limit | No Limit | No Limit |

| Hospital Room & Board | Capped at RM100 per day | Standard Single or Basic Single Room (Max RM300 per day for non-panel hospitals) | RM180, RM250, or RM350 per day | RM180, RM250, RM350, or RM500 per day |

| Cost-Saving & Deductible Options | None available; fixed pool pricing | RM500 per Policy Year, or RM500, RM3,000, or RM20,000 per Disability |

|

|

| Notable Core Features | Basic pooling system covering essential hospitalization and surgical expenses. | Digital-first, purchased and managed exclusively via the Touch ‘n Go eWallet app. | Provides discounts of at least 20% on premiums via the SMART Journey network (Clinic -> Specialist -> Hospital). | Offers a “Health Wallet” that rewards claim-free years by crediting funds up to 10 times for out-of-pocket care. |

| Outpatient Coverage (Cancer/Dialysis) | Not explicitly covered/highlighted outside of general limit | As Charged, subject to Annual Limit | Covered under the Annual Limit | Full coverage for outpatient kidney dialysis and cancer treatment up to the Annual Limit |

| Rewards & Upgrades | None | None | Eligible for AIA Vitality benefits, offering up to a 100% upgrade in the Room & Board limit and Health Screening benefits. | AIA Vitality benefits offer Room & Board upgrades (up to +100%) and up to an additional +10% Health Wallet booster per year. |

| Add-on Riders Available | None | None | Can be bundled with A-Plus MediBoost (increases limit to RM1.5m) and A-Plus MediRecover. | Includes Personal Medical Case Management (PMCM) for guided, global specialist treatment paths. |

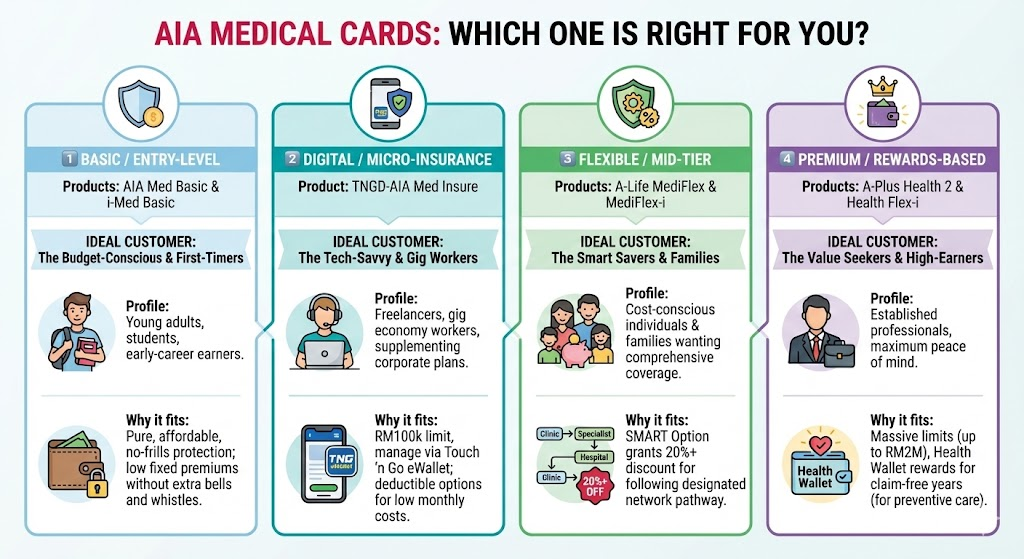

🎯 AIA MEDICAL CARDS: WHICH ONE IS RIGHT FOR YOU?

1️⃣ BASIC / ENTRY-LEVEL

- Products: AIA Med Basic & i-Med Basic

- Ideal Customer: The Budget-Conscious & First-Timers

- Profile: Young adults, college students, or early-career earners.

- Why it fits: Provides pure, affordable, no-frills protection against major hospitalization bills. It offers low fixed premiums without making you pay for extra bells and whistles you may not need yet.

2️⃣ DIGITAL / MICRO-INSURANCE

- Product: TNGD-AIA Med Insure

- Ideal Customer: The Tech-Savvy & Gig Workers

- Profile: Freelancers, gig economy workers, or corporate employees supplementing their basic company insurance.

- Why it fits: Offers a solid RM100,000 annual limit with the ultimate convenience of managing the policy entirely via the Touch ‘n Go eWallet app. The deductible options keep monthly costs incredibly low, making it perfect for independent workers with variable incomes.

3️⃣ FLEXIBLE / MID-TIER

- Products: A-Life MediFlex & MediFlex-i

- Ideal Customer: The Smart Savers & Families

- Profile: Cost-conscious individuals and families who want comprehensive coverage but are willing to optimize how they access healthcare to save money.

- Why it fits: Features the “SMART Option,” which grants at least a 20% discount on premiums simply by agreeing to follow a designated network pathway (Clinic -> Specialist -> Hospital) for non-emergency treatments.

4️⃣ PREMIUM / REWARDS-BASED

- Products: A-Plus Health 2 & Health Flex-i

- Ideal Customer: The Value Seekers & High-Earners

- Profile: Established professionals and those who want maximum peace of mind with the absolute best healthcare access.

- Why it fits: Offers massive annual limits (up to RM2 Million) and the innovative “Health Wallet” feature. Instead of “losing” your premium if you don’t get sick, you are rewarded for claim-free years with funds that can be used for out-of-pocket preventive care like health screenings, vaccinations, and mental health consultations.

AIA Medical Card Premium Pricing Estimator

Factors Affecting AIA Medical Card Price

The cost of an AIA medical card varies based on several factors, including:

- Age of Policyholder – Premiums increase as you get older due to higher medical risks.

- Coverage Type – Plans with higher annual limits, lifetime coverage, and critical illness benefits tend to have higher premiums.

- Plan Type – Individual plans are cheaper, while family plans cost more but provide extensive coverage.

- Hospital Room & Board Limit – Higher room and board limits (e.g., RM150 vs RM500 per night) result in higher premiums.

- Optional Add-ons – Extra benefits like outpatient coverage, maternity benefits, and wellness programs can increase costs.

- Pre-existing Conditions – Coverage for individuals with pre-existing conditions may come with exclusions or higher premiums.

AIA Medical Card Plans and Their Pricing

Because medical insurance premiums are highly personalized, there is no single “flat rate” for everyone. AIA calculates your exact premium based on several factors: Age, Gender, Occupation Class, Health/Smoking Status, and the specific Plan, Deductibles, and Riders you select.

However, to give you a clear idea of what to expect, I have extracted the pricing structures and sample benchmark rates from the product brochures.

Here is a sample pricing schedule across the different tiers:

1. Digital / Micro-Insurance: TNGD-AIA Med Insure

Pricing Structure: Premiums increase annually based on your exact age. Males and females have the same rates at younger ages, but rates diverge slightly as you get older. Sample Rates (Plan: RM100k Limit with RM500 Deductible per Policy Year)

- Age 18 (Male/Female): RM 29.58 / month (RM 340.00 / year)

- Age 30 (Male/Female): Prices scale incrementally between age 18 and 45

- Age 45 (Male): RM 70.05 / month (RM 805.13 / year)

- Age 45 (Female): RM 61.59 / month (RM 707.91 / year)

2. Basic / Entry-Level: AIA Med Basic & i-Med Basic

Pricing Structure: Premiums are grouped into 5-year “Age Bands”. Your premium remains flat for 5 years and then jumps to the next tier when you cross into a new age band. Rates differ by gender and occupation class. Sample Rates (Female, Occupation Class 1 & 2 – Indoor/Office Workers)

- Age 16 – 20: RM 689.00 / year

- Age 26 – 30: RM 979.00 / year

- Age 36 – 40: RM 1,212.00 / year

- Age 46 – 50: RM 1,571.00 / year

3. Flexible Mid-Tier: A-Life MediFlex

Pricing Structure: Because this plan is highly customizable, pricing is completely individualized. However, choosing the “SMART Option” guarantees you at least a 20% discount on your base premium. Official AIA Brochure Benchmark Case Study:

- Profile: 30-year-old Male, Non-Smoker.

- Plan Setup: Plan 250 (RM250 Room & Board) + A-Plus MediBoost Rider (RM 1 Million Limit) + A-Plus MediRecover Rider (RM50,000 lump sum).

- Cost-Saving Option Selected: RM500 Deductible per disability with the SMART Option (network discount).

- Resulting Premium: RM 124.27 / month (Approx. RM 1,491 / year).

4. Premium / Rewards-Based: A-Plus Health 2

Pricing Structure: This is AIA’s most comprehensive and premium-priced tier. Pricing scales based on the high limits (up to RM2 million) and the inclusion of the Health Wallet feature. While exact tables are not publicly listed without a custom quotation, you can expect premiums for an average 30-year-old to generally range from RM 2,000 to RM 3,500+ per year, depending on the exact deductible chosen (e.g., zero deductible vs. RM500 deductible).

How to Lower Your Premium on the Higher-Tier Plans: If you want the comprehensive coverage of MediFlex or Health 2 but find the initial quotes too high, AIA allows you to drastically reduce your premium by selecting:

- A Deductible: Agreeing to pay the first RM3,000, or RM20,000 of any hospital bill out of your own pocket.

- The SMART Option: Agreeing to only seek non-emergency treatment at specifically designated SMART Clinics and Hospitals.

How to Choose the Best AIA Medical Card for Your Needs

To select the best AIA medical card, consider the following:

- Assess Your Healthcare Needs – Determine whether you need coverage for hospitalization, outpatient care, or critical illnesses.

- Set a Budget – Choose a plan that fits your financial situation while providing adequate coverage.

- Compare Plans – Analyze different AIA medical card options based on benefits and premiums.

- Check Hospital Panel – Ensure your preferred hospitals are included in AIA’s network.

- Look for Value-Added Benefits – Consider additional features like wellness programs and critical illness coverage.

- Consult an Expert – Seeking professional advice can help you make an informed decision.

Let Us Help You Find the Best AIA Medical Card?

Navigating the insurance market can be overwhelming, but we make the process easier by:

- Providing Personalized Recommendations – We assess your needs and suggest the best plan for you.

- Comparing Multiple Options – We compare different AIA medical cards to find the most cost-effective coverage.

- Assisting with the Application Process – We handle paperwork and ensure a hassle-free enrollment.

- Helping You Save Money – We guide you toward securing the lowest possible premium while maximizing coverage.

Get in Touch for a Free Consultation

If you’re looking for an AIA medical card that fits your needs and budget, we’re here to help! Contact us today for a free consultation, and let us assist you in securing the best healthcare protection at the most affordable price!

Hi AIA Takaful,

I would like to request a few quotations for Shariah-compliant Medical Card Takaful plans for a female, age 46. My target budget is around RM50-150 per month.

Please provide quotations (monthly contribution) and details plan highlights for a few suitable options from AIA Takaful.

Hi, thanks for your interest in AIA Takaful Medical Card plans!

I can help you prepare a few Shariah-compliant medical card quotations that fit your budget (RM50–150/month).

But in order to generate an accurate quotation, I’ll just need a few quick details:

Height & Weight

Occupation

Current Health Status

Any existing illnesses?

Any surgeries, hospital admissions, or medications?

Do you have any existing medical card / takaful coverage?

Once I have these, I can suggest the best options—for example:

A-Life i-Med Basic (budget plan)

A-Life MedFresh / Mediflex (flexible deductible options)

Higher tier plans with no lifetime limit (if preferred)

Feel free to send the details using the comment section whenever convenient and I’ll prepare the quotations right away. 😊

Hi there, Azura. Thank you so much for your comment. I would also like to add that a budget of RM100–150 per month (for female age 46) can be sufficient for a basic Shariah-compliant medical card, especially plans like AIA i-Med Basic or other entry-level medical takaful options. At this price range, you can usually get essential hospitalisation and surgical coverage, including room and board, ICU, and in-hospital treatment, but with lower annual limits and some deductibles or co-takaful. It won’t be a fully comprehensive plan, and benefits like outpatient treatment, higher room limits, and bigger annual limits may require a higher monthly contribution. For someone aged 46 who is generally healthy, this budget is still workable to secure a good, decent basic medical card as a safety net—but the exact premium depends on details like height, weight, occupation, smoking status, and medical history.

Based on the AIA i-Med Basic contribution table, your budget of RM100–150 a month is generally sufficient for a Shariah-compliant medical card at age 46. For example, for a 46-year-old female with a standard office-type occupation (Class 1–2), the estimated contribution is about RM100/month for the RM300 deductible option, which gives you hospitalisation and surgical coverage up to RM20,000 annual limit and RM80,000 lifetime limit, with RM100/day room & board until age 70.

There is also a version with 5% co-takaful (you pay 5% of the bill, up to RM1,000 per year) where the monthly contribution is around RM157/month, which is slightly above your target budget but still close. If you can confirm your occupation class and whether you prefer a higher deductible (lower monthly cost) or co-takaful (sharing a small percentage of each bill), I can recommend the most suitable option within or very close to your budget. Get in touch with us via whatsapp if you need faster assistance.

Age 70 is monthly payment?

Hi there Mr Jeya Das, thanks so much for your question. For individuals aged over 50, medical coverage will be very expensive now. For people at around 70 years old, if this is your first medical card, it will be quite difficult to secure a medical coverage with any insurer in Malaysia. Your medical card application will also need to undergo manual approval at insurer’s HQ and also a full medical checkup is definitely required. For people aged 70 years old, one can expect to pay more than RM 2500 per month for a medical card.

Perlindungan aia utk family Dan parents.

Mom – 50 thn

Dad – 50 then

Me – 21 then

Brother – 15thn

Terima kasih Nurul Alia atas komen dan kepercayaan anda 😊

Kami sangat berbesar hati untuk membantu anda dan keluarga.

Untuk sediakan cadangan pelan perubatan AIA yang tepat bagi ibu, ayah, adik dan diri anda, kami perlukan sedikit maklumat tambahan kerana sebut harga perubatan tidak boleh ditentukan berdasarkan umur sahaja. Antara maklumat penting termasuk pekerjaan, status kesihatan, sejarah perubatan dan sebarang kondisi sedia ada.

Jika berkenan, Nurul boleh tinggalkan nombor telefon supaya kami boleh hubungi melalui WhatsApp. Melalui WhatsApp, lebih mudah untuk kami terangkan pilihan pelan dan bantu anda satu-persatu dengan lebih jelas.

Untuk makluman juga, umur 21 tahun dikategorikan sebagai dewasa, jadi tidak boleh dimasukkan dalam pelan medical card keluarga. Namun, ibu, ayah dan adik (15 tahun) masih boleh memohon medical card keluarga dan biasanya akan menikmati premium yang lebih rendah berbanding permohonan individu.

Sekali lagi, terima kasih Nurul. Kami di Medicard.my sedia membantu dan membimbing anda memilih perlindungan perubatan yang paling sesuai untuk keluarga ❤️