As a business owner or HR leader in Malaysia, offering robust medical insurance is no longer just a “perk”—it is a necessity for talent retention. AIA Malaysia stands out as a market leader in this space, offering some of the most digital-forward and comprehensive plans available.

Whether you are running a lean SME or a large multinational corporation, navigating the options can be complex. This guide breaks down exactly how AIA’s group insurance works, the specific plans available, and the “insider” details you need to know before signing a policy.

The Definitive Guide to AIA Group Medical Insurance in Malaysia

As a business owner or HR leader in Malaysia, offering robust medical insurance is no longer just a “perk”—it is a necessity for talent retention. AIA Malaysia stands out as a market leader in this space, offering some of the most digital-forward and comprehensive plans available.

Whether you are running a lean SME or a large multinational corporation, navigating the options can be complex. This guide breaks down exactly how AIA’s group insurance works, the specific plans available, and the “insider” details you need to know before signing a policy.

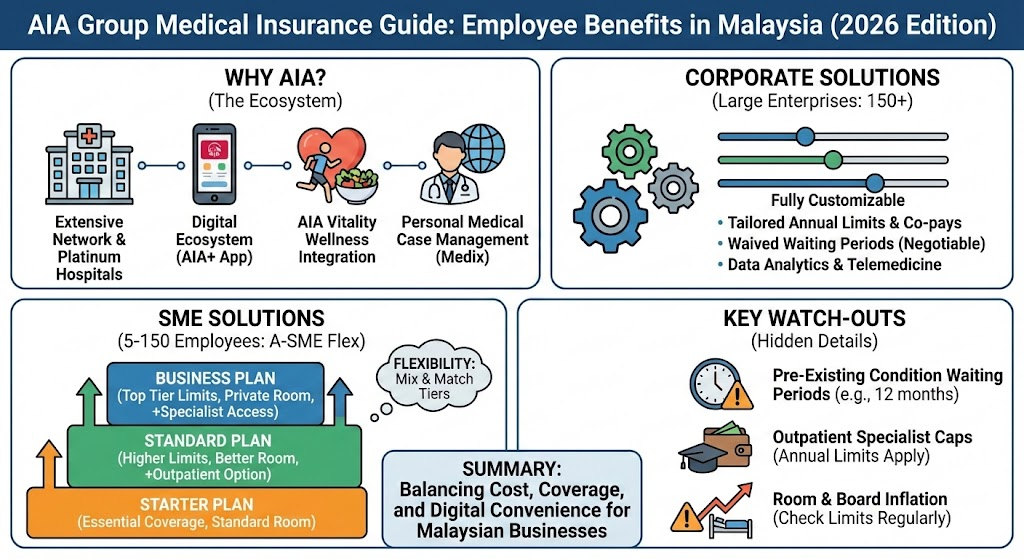

Why AIA for Employee Benefits?

Before diving into the specific plans, it is important to understand why AIA is often the default choice for many Malaysian companies.

Personal Medical Case Management (Medix): For serious illnesses, AIA partners with Medix to provide independent medical case management, ensuring your employees get the right diagnosis and treatment plan from global experts.

Extensive Hospital Network: AIA has one of the largest panels of GP clinics and hospitals in Malaysia. Their “Platinum Hospital” program often provides smoother admission processes and preferred room availability.

Digital Ecosystem (AIA+): Their employee app is arguably the best in the market. Employees can view their medical card (e-card), track claims, and find clinics entirely through their phones, reducing the administrative burden on your HR team.

AIA Vitality Integration: Unlike traditional insurers that only pay when you get sick, AIA offers corporate integration with AIA Vitality, a wellness program that rewards employees for staying healthy.

Solutions for SMEs (5 to 150 Employees)

For small and medium enterprises, AIA offers a product called A-SME Flex (and its Takaful equivalent, A-SME Flex-i). This is a “packaged” solution designed to be easy to buy and administer without needing a customized quote for every single benefit.

The 3 Core Plan Options

A-SME Flex is typically divided into three tiers to suit different budgets:

- Starter Plan:

- Best for: Startups or companies with a tight budget who want to provide essential “catastrophic” coverage.

- Coverage: Focuses primarily on Hospitalization & Surgical (GHS).

- Annual Limit: Generally starts lower (e.g., around RM40,000 per employee per year) to keep premiums affordable.

- Room & Board: usually covers standard 4-bedded rooms.

- Standard Plan:

- Best for: Established SMEs looking to be competitive in the job market.

- Coverage: Includes higher annual limits and better room and board rates (often 2-bedded or semi-private).

- Add-ons: Easier to attach outpatient GP or specialist coverage at this level.

- Business Plan:

- Best for: Senior management or companies prioritizing top-tier benefits.

- Coverage: High annual limits (often RM120,000+) and coverage for single/private rooms.

- Perks: Access to higher tiers of outpatient care and specialist visits.

Key Features of A-SME Flex

- Flexibility: As the name suggests, you can “mix and match.” You might put your general staff on the Standard Plan and your C-suite on the Business Plan.

- Cashless Outpatient: If you opt for the outpatient rider, employees can visit panel GP clinics cashless using the app.

- No Medical Check-up: generally, for standard group sizes, coverage is “guaranteed issue” (subject to waiting periods for pre-existing conditions), meaning employees don’t need to undergo individual medical exams.

Corporate Solutions (Large Enterprises)

If your company has a large headcount (typically above 150 or 200 employees), you move out of the “packaged” SME world and into Corporate Solutions.

Customization is King

Unlike the fixed tiers of A-SME Flex, corporate plans are fully customizable. You can negotiate:

- Annual Limits: Tailored to your company’s risk appetite (e.g., RM200k, RM500k, or unlimited).

- Co-payment/Deductibles: You can introduce a co-pay (e.g., employee pays RM50 per visit) to lower the corporate premium.

- Waiting Periods: Large corporates can often negotiate to waive waiting periods for pre-existing conditions, ensuring staff are covered from Day 1.

Exclusive Corporate Features

- Data Analytics: HR receives detailed utilization reports. You can see if your staff are struggling with chronic issues (like hypertension) and design wellness interventions accordingly.

- Telemedicine: Direct access to digital health services where employees can consult doctors via video call and get medicine delivered.

The “Hidden” Details: What to Watch Out For

As an advisor, I often see companies overlook these critical clauses. Pay attention to these three areas:

1. The “Pre-Existing Condition” Clause For the SME plan (A-SME Flex), pre-existing illnesses are usually not covered immediately. There is typically a waiting period (often 12 months) before chronic conditions like diabetes or high blood pressure are claimable. Ensure your employees understand this so they don’t get a shock when a claim is rejected in the first year.

2. Outpatient Specialist Caps While GP visits are often unlimited, visits to a Specialist (e.g., an ENT or Cardiologist) usually have a strict annual limit (e.g., RM2,000 or RM3,000). If an employee has a long-term issue requiring frequent specialist reviews, they may max out this benefit quickly.

3. Room & Board Inflation Hospital room rates increase every year. A plan that covers RM150/day might have been fine five years ago, but today, a standard single room in a major Klang Valley hospital can cost RM250-RM350. Always advise your company to review the Room & Board limit to ensure employees don’t have to pay “top-up” fees out of pocket.

How to Apply

- Determine Headcount: Confirm exactly how many employees will be enrolled. The minimum for A-SME Flex is 5 employees.

- Choose Your Tiers: Decide if you want a flat plan for everyone or tiered benefits (Management vs. Staff).

- Prepare Documents: You will generally need your Business Registration (SSM), latest EPF statement (to prove employment), and employee census data (Name, DOB, Gender, Occupation).

- Contact an Intermediary: Group insurance is complex. It is highly recommended to engage a corporate insurance agent or broker rather than buying direct, as they will handle the inevitable claims disputes and renewal negotiations for you.

Final Verdict

AIA is rarely the cheapest option in the market, but it is often the best value for money due to the reliability of their claims processing and the strength of their app. If your priority is minimizing HR headaches and providing a “premium” feeling benefit to staff, AIA Group Medical is a top-tier contender.

To get started with setting up corporate/group coverage for your company today get in touch with us:

Stop guessing with your employee benefits and start optimizing them. With over 20 years of specialized experience in the Malaysian insurance landscape, we don’t just sell AIA policies—we audit and architect them to eliminate costly blind spots your previous agent may have missed. Whether you need to trim wasted premiums or secure airtight protection that truly retains talent, our deep market insight ensures you get the maximum coverage efficiency for every Ringgit spent. Contact us today for a complimentary policy review and a tailored AIA Group Insurance quotation that puts your business interests first.