Look, I’ve been in this game for over 20 years. I’ve sat in living rooms from PJ to Penang, drinking countless cups of teh tarik while reviewing policies. I’ve seen families devastated because they thought they were “fully covered,” and I’ve seen clients jump for joy because a tiny, cheap policy paid out when they least expected it.

Today, I want to talk to you about the underdog of the insurance world: Personal Accident (PA) Insurance.

Most Malaysians are obsessed with Medical Cards (which is good!) and Life Insurance (also good!). But PA? It’s often the afterthought. The policy you buy because the bank teller asked you to, or because it was an add-on to your car insurance.

But let me tell you—dollar for dollar, PA is often the best value protection you can own. Let me explain why, and how to get it right.

The Big Confusion: “I Have a Medical Card, Why Do I Need PA?”

I hear this every day. “Uncle, I have a RM1 million annual limit medical card. Why do I need this RM200 PA policy?”

Here is the secret: Medical Cards have a “hole” in them.

If you slip in your bathroom, cut your head open, and need 5 stitches at the 24-hour clinic, your Medical Card usually won’t pay a cent. Why? Because most medical cards only cover hospital admission or major surgeries. Outpatient treatments for accidents (like sprains, cuts, or broken fingers that don’t need overnight stays) are often excluded or subject to high deductibles.

This is where PA shines. PA pays for the “small stuff” that happens way more often than the big stuff.

- Scenario: You twist your ankle playing badminton.

- Medical Card: “Sorry, no admission, no pay.”

- PA Policy: “Here is RM500 for your X-ray, consultation, and physio.”

It fills the gap. Think of your Medical Card as the roof over your head, and PA as the umbrella for when you walk to the car.

For Sports Enthusiasts

Here is the deal with sports: standard PA policies usually cover amateur participation, so if you twist an ankle at a weekend charity run or get elbowed during a friendly futsal match, you are generally safe. However, the “red card” comes out if you are participating professionally (where you earn income from it) or engaging in what insurers list as “Hazardous Sports”—think motor racing, martial arts sparring, or bungee jumping. Crucially, check if your specific policy excludes “organized competitions” or “racing”; while many modern plans cover marathons (because they often only exclude “racing other than on foot”), competitive cycling or semi-pro leagues often require a specialized “Sports PA” add-on.

| Benefit Name | What It Actually Covers | Why You Need It (Real Scenarios) |

| Accidental Medical Reimbursement | Pays your outpatient bills at private clinics or hospitals. No admission needed. | You twist your ankle at the 10km mark of a run. You need an X-ray, consultation, and painkillers. A Medical Card won’t pay this (no admission), but PA pays the full RM400 bill. |

| Alternative Medicine (Sinseh/Chiro) | Covers licensed traditional treatment like acupuncture, bone-setting (tit-tar), or chiropractic adjustments. | You pull a muscle at futsal. Western doctors give you painkillers, but you prefer the Sinseh to “rub out the wind.” Most good PA plans give you ~RM500 per accident for this. |

| Mobility Aids & Equipment | Reimbursement for buying or renting crutches, wheelchairs, or orthopedic braces. | You tear a ligament (ACL) during a friendly basketball game. You need a knee brace (RM300) and crutches (RM100) to move around the office for 3 weeks. |

| Weekly Indemnity (Temporary Disablement) | A weekly cash allowance if a doctor certifies you cannot work due to the injury (MC given). | You break your wrist cycling and can’t type or drive to work for 2 weeks. This pays you a weekly cash sum (e.g., RM200/week) to cover transport or lunch costs while you recover. |

| Daily Hospital Income | Cash money for every night you stay in the hospital due to an accident. | A bad tackle breaks your leg and you are stuck in Sunway Medical for 3 nights. On top of your medical bill being paid, PA gives you ~RM100-RM200 per night as “sorry allowance.” |

| Ambulance Fees | Covers the cost of the ambulance ride to the hospital. | You collapse or break a bone on a hiking trail and need a private ambulance to fetch you. That RM400 ride is claimable. |

| Permanent Disablement (Partial) | A lump sum payment if you lose function of a specific body part (based on a %). | A stray shuttlecock or tennis ball hits your eye, causing permanent partial vision loss. The policy pays a % of the total sum assured (e.g., RM30,000) to help you adjust to life. |

Pro tip: If you are joining a mass participation event (like the KL Marathon or a generic Fun Ride), check if your policy has a “Sanctioned Events” clause. Some older policies strictly exclude any organized race, while modern ones allow it as long as you aren’t paid to race.

Know Your “Class”: The Price Tag Secret

Before you rush to buy, you need to know where you stand. Unlike Life Insurance which looks at your age and health, PA looks at your Occupation Class.

I’ve seen claims rejected because a client lied about this. Don’t be that person.

- Class 1 (office based work) You sit in air-conditioning. Admin, accountants, lawyers, programmers.

- Risk: Low.

- Price: Dirt cheap. (Approx. RM100 – RM200/year for RM100k coverage).

- Class 2 (on-the-go): You supervise site work or travel often for sales. Sales agents, site engineers (supervisory), property agents.

- Risk: Medium.

- Price: Moderate.

- Class 3 (labour intensive work): You use tools or machinery. Mechanics, factory workers, grab riders (sometimes Class 4 depending on insurer).

- Risk: High.

- Price: Higher, and some insurers might decline.

Pro Tip: If you change jobs from an Accountant (Class 1) to a Site Supervisor (Class 2), notify your agent immediately. If you don’t, and you get hurt on site, the insurer can pay you less or void the claim.

What Are You Actually Getting? (Beyond Death)

Yes, PA pays a lump sum if you pass away due to an accident. But if you survive (which we hope you do!), here is what matters:

1. Medical Reimbursement (The Most Used Benefit)

This is the “cash back” for your accident bills.

- What it covers: Clinical visits, X-rays, medicines, and crucially in Malaysia—Sinseh / Traditional Treatment.

- Real Life Example: I had a client who fell off his bike. He went to a clinic for dressing (RM150) and then to a licensed Sinseh for tit-tar (bone setting) (RM300). His PA policy covered both because it had a “Traditional Medicine” allowance (usually capped at RM500-RM1,000 per accident).

2. The “Loss of Use” Scale

You don’t have to lose an entire arm to get paid. PA policies have a Schedule of Benefits.

- Lose a thumb? You might get 20% of the sum assured.

- Lose sight in one eye? 50% or 100% depending on the plan.

- Insider Note: This also applies to “Permanent Loss of Use.” If the doctor certifies your finger is still attached but stiff and useless forever, that counts as a loss!

3. The “Double Indemnity” Bonus

Many Malaysian policies pay double the death benefit if the accident happens on Public Transport (LRT, Bus) or during a Public Holiday.

- Balik Kampung special: If an accident happens while you are driving home for Raya on a gazetted public holiday, a RM100,000 policy could suddenly become a RM200,000 payout. Check your policy wording!

4. Snatch Theft & ATM Mugging

This is sadly relevant in KL. Good PA plans now include a small compensation (e.g., RM500 – RM1,000) if you are a victim of snatch theft, to cover the loss of your bag and IC replacement fees.

How to Avoid a Rejected Claim

I’ve been the guy delivering the bad news, and I hate it. Here is how to make sure your claim gets approved.

1. The “Motorcycle” Clause If you ride a motorbike, check the policy. Many standard PA policies exclude motorcycling unless you pay an extra premium (about RM30-RM50). If you just hop on a friend’s bike to go to the mamak and crash, you might get zero if you didn’t tick that box.

2. The 30-Day Rule You cannot wait 3 months to tell us you fell down. Most insurers require notice within 14 to 30 days. Even if you are busy, send a WhatsApp to your agent immediately. “Eh, I fell down, might claim later.” That text message stamps the date.

3. “Original Receipts” Only For Medical Reimbursement, photos or photocopies are usually not accepted. Keep the original physical receipt from the clinic. If you lose it, you lose the money.

4. The Pre-existing Condition Trap If you have a weak knee from football 10 years ago, and you twist it again, the insurer might argue it’s not a “new” accident. However, if the accident was severe enough that it would have injured a healthy knee, we can fight for you.

The Nomination

This is where families break apart. You must nominate a beneficiary.

- For Non-Muslims: If you nominate your Spouse, Child, or Parent (if no spouse/child), a Trust is created. The money goes directly to them, bypassing your Will and creditors. It is instant cash for them to survive.

- For Muslims: Your nominee is an Executor (Wasi). They receive the money, but they must distribute it according to Faraid laws. They cannot just keep it all unless all other heirs agree.

- The Mistake: I see single young people nominate their girlfriend/boyfriend. Don’t do this. It creates a legal mess. Stick to parents or siblings until you are married.

How Much Should You Spend?

You don’t need to break the bank.

- Standard Plan: RM50,000 Death / RM2,000 Medical Reimbursement.

- Cost: ~RM60 – RM80 per year. (Yes, per year!).

- Solid Plan: RM100,000 Death / RM5,000 Medical / Weekly Income Benefit.

- Cost: ~RM150 – RM200 per year.

- Platinum Plan: RM500,000+ Death / High Medical.

- Cost: ~RM600+ per year.

My Advice: Go for the Solid Plan. The jump from RM2,000 to RM5,000 in medical reimbursement is worth the extra RM50 premium. One bad fall or a minor bike accident can easily bill RM3,000 at a private hospital emergency room.

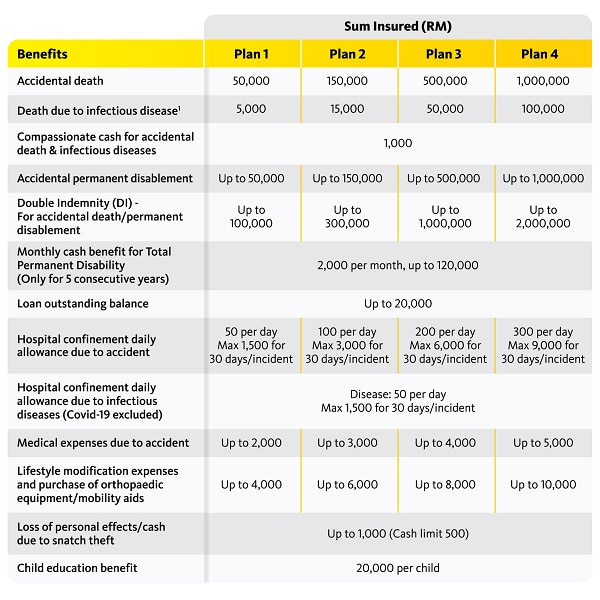

For reference, this is Maybank’s Infinite Personal Accident Product Benefit Schedule.