In the crowded landscape of Malaysian insurance—where agents often push “all-in-one” Investment-Linked Policies (ILPs)—the standalone medical card remains a powerful, often overlooked tool. It is insurance in its purest form: you pay a fee, and the insurer covers your hospital bills. No investments, no unit-splitting, no confusion.

For many Malaysians facing rising living costs and medical inflation, the standalone card is an attractive alternative to expensive bundled plans. But is it right for you? This guide breaks down the pros and cons, and the critical differences you need to know before signing up.

What is a Standalone Medical Card?

A standalone medical card is a term medical assurance policy dedicated solely to health coverage. Unlike an Investment-Linked Policy (ILP), which mixes insurance with an investment fund, a standalone card has no cash value.

Think of it like car insurance: you pay the premium to protect yourself against a specific risk (hospitalization) for a specific period (usually one year). If you don’t get sick, you don’t get your money back. If you stop paying, the policy terminates immediately with no savings to fall back on.

The Key Difference: Structure

- Standalone: 100% of your premium goes toward the “Cost of Insurance” (risk charges) and administrative fees.

- ILP: Your premium is split. Part of it pays for insurance, and the rest buys units in a fund (equity/bond). The insurer sells these units later to cover higher insurance charges as you age, theoretically “smoothing” out the premium.

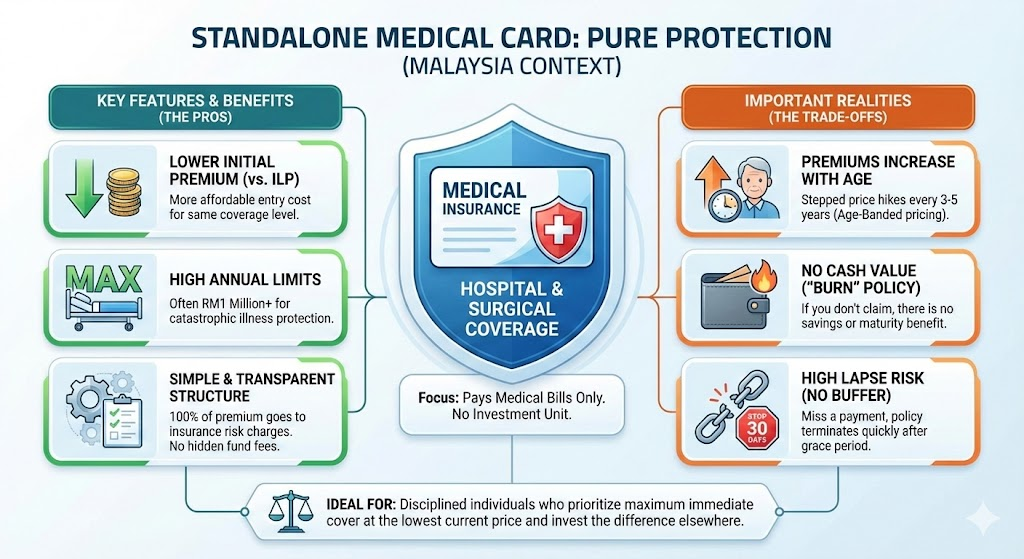

The Pros of a Standalone Medical Card

1. Significantly Lower Entry Cost

This is the primary selling point. Because you are not paying extra to build an investment pot, standalone cards are roughly 40% to 60% cheaper than ILPs for the same level of medical coverage.

- Example: A fresh graduate (age 24) might pay RM250/month for an ILP but only RM100/month for a standalone card with identical annual limits.

2. “Buy Term, Invest the Difference”

Financial savvy Malaysians often prefer standalone cards because they separate insurance from investment. By saving RM150/month (the difference between an ILP and standalone premium) and investing it yourself in ASB, EPF, or a low-cost ETF, you often achieve better long-term returns without the high upfront commissions deducted by insurance funds.

3. Simplicity and Transparency

Standalone policies are easier to understand. There are no “sustainability clauses” regarding unit values or confusing fund fact sheets. You don’t have to worry about the stock market crashing and affecting your medical coverage’s sustainability.

4. High Annual Limits are Standard

Competition has forced insurers to upgrade standalone plans. Today, it is common to find standalone cards with Annual Limits of RM1 million or more, ensuring you are covered even for catastrophic illnesses like cancer or heart bypass surgeries.

The Cons of a Standalone Medical Card

1. Premiums Increase with Age (Step-Up Pricing)

This is the biggest trade-off. Standalone premiums are strictly age-banded.

- Age 25: Cheap (e.g., RM1,200/year).

- Age 45: Moderate (e.g., RM4,000/year).

- Age 65+: Expensive (e.g., easily RM10,000+/year). Unlike ILPs, which aim to keep premiums flat (level) by using the accumulated cash value to subsidize later years, standalone cards require you to budget for these scheduled increases every 5 years.

2. No “Auto-Pilot” Feature

If you miss a payment on a standalone card, your policy lapses (cancels) within the 30-day grace period. There is no cash value to automatically pay the premium for you. An ILP, by contrast, can use its built-in cash value to keep the policy active for months or years even if you stop paying, serving as a safety net during temporary financial hardship.

3. Still Subject to Repricing Inflation

While age-based increases are predictable, medical inflation repricing is not. If the insurer experiences high claims across their entire portfolio, they can petition Bank Negara Malaysia (BNM) to raise the base rates for everyone, on top of your age increase.

- Note: This affects ILPs too, but standalone cardholders feel the pinch more directly as there is no cash value to absorb the shock.

Comparison: Standalone vs. Investment-Linked Policy (ILP)

| Feature | Standalone Medical Card | Investment-Linked Policy (ILP) |

| Primary Goal | Pure medical protection. | Protection + Wealth Accumulation. |

| Monthly Cost | Low (Cheapest option). | High (Includes savings portion). |

| Premium Structure | Increases every 3–5 years (Age-banded). | Generally level (flat), but subject to sustainability repricing. |

| Cash Value | None. “Burn” policy. | Yes. Can be withdrawn or used to pay premiums. |

| Lapse Risk | High. Miss 1 payment = Policy ends. | Low. Can survive on cash value for a while. |

| Complexity | Low. Easy to compare. | High. fees, unit prices, fund performance matter. |

Medical Inflation

It is vital to address the current climate in Malaysia. Medical inflation is running at 10-15% annually.

- The ILP Myth: Many agents sell ILPs claiming the premium “never rises.” This is becoming less true. Due to high medical costs, many ILPs have run out of cash value, forcing insurers to ask policyholders to “top up” or face a lapse.

- The Standalone Reality: Standalone cards are honest about the cost. You know it will get more expensive. This transparency allows you to plan, whereas an ILP might hit you with a surprise repricing letter 10 years down the road when the investment fund underperforms.

Who Should Choose a Standalone Medical Card?

1. Fresh Graduates & Young Professionals

When you are earning a starting salary (e.g., RM3,000), cash flow is king. Paying RM300 for an ILP is a burden. Paying RM100 for a standalone card ensures you are covered without sacrificing your lifestyle or ability to save for a house. You can switch to an investment linked policy when your finances and income improve in the future but then there’s an argument to be made for buying an ILP policy early.

2. The “Buy Term, Invest the Difference” Investor

If you are disciplined enough to invest the money you save, standalone is mathematically superior. However, not everyone is as good an active investor they think they are. So think carefully before you decide.

- Scenario: You save RM2,400/year by choosing standalone over ILP. If you invest that RM2,400 in EPF (giving ~5-6%), you will likely have a larger emergency fund for your old age premiums than the cash value generated inside an insurance policy (which incurs fund management fees).

3. People with Existing Life Insurance

If you already have a Whole Life policy or significant Life/TPD coverage, you don’t need the bundled life insurance that comes with most ILPs. You just need to cover hospital bills. A standalone card acts as a pure “hospital admission ticket.”

4. Business Owners

Business owners often prefer standalone cards for employees or themselves because the lower commitment helps cash flow, and they usually rely on their business assets for “investment” rather than insurance funds.

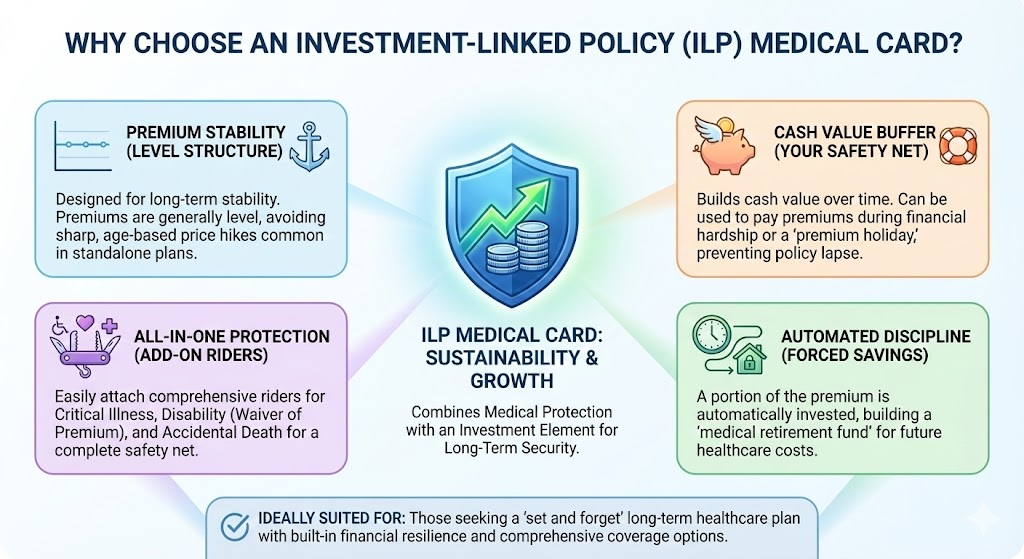

Who Should Stick with an ILP?

- Undisciplined Savers: If you know that paying a cheaper premium means you will just spend the extra money on Starbucks or Shopee, get an ILP. The forced savings element ensures you are building a reserve to help pay for insurance in your old age.

- Those Seeking “Set and Forget”: If you want to set up a standing instruction and not worry about increasing premiums every 5 years (at least for the first 10-15 years), the ILP offers a smoother user experience.

Final Verdict: How to Decide?

The decision comes down to discipline vs. convenience.

If you choose a Standalone Medical Card, you are choosing efficiency. You are paying the lowest possible price for the maximum coverage. However, you must accept the responsibility of saving money elsewhere to afford the higher premiums when you are 60 or 70 years old.

If you choose an ILP, you are paying for convenience and a safety net. You are overpaying now to subsidize your future self, outsourcing the investment discipline to the insurance company.

Here are a Few Reasons You Should Consider Getting an Investment Linked Policy

The “Medical Retirement” Strategy

While a standalone card is excellent for immediate protection, an Investment-Linked Policy (ILP) is built for the long game. Think of it as ‘pre-funding’ your future healthcare. By paying a slightly higher premium during your prime earning years, you are building a cash reserve that helps buffer the inevitable cost of insurance as you age. This structure is designed to make your medical coverage more sustainable in your retirement years, preventing the ‘sticker shock’ of steep age-based price hikes exactly when your income has stopped.

The Safety Net: Protection Against Life’s Hiccups

The hidden danger of a standalone medical card is its fragility—miss one payment, and your coverage often ceases immediately. An ILP offers a critical safety net: the Cash Value. In times of financial hardship, job transition, or simple forgetfulness, the accumulated cash value in your policy can automatically pay your premium charges, keeping your coverage active for months or even years without out-of-pocket payments. This ‘auto-pilot’ feature ensures that a temporary financial stumble doesn’t leave you medically defenseless.

Comprehensive Defense: More Than Just Hospital Bills

Healthcare is rarely just about paying the hospital bill; it’s also about protecting your income while you recover. ILPs offer a unique advantage here through Waiver of Premium riders. If you are diagnosed with a critical illness or become permanently disabled, the insurance company will step in and pay your future premiums for you. This ensures your medical card remains free and active for life, allowing you to focus entirely on recovery without the burden of monthly payments—a feature rarely found in basic standalone plans.

The Discipline of “Forced Savings”

Financial gurus often preach ‘Buy Term, Invest the Difference,’ but behavioral economics tells us a different story: most people spend the difference. An ILP automates your discipline. By bundling your protection with a savings element, it ensures that a portion of your money is always working toward future-proofing your healthcare costs. It removes the temptation to spend those extra funds, ensuring that your ‘medical retirement fund’ grows silently in the background.

Recommendation:

For most financially conscious Malaysians, a Standalone Medical Card + Personal Investment (EPF/ASB) is the optimal financial route. It keeps your insurance pure and your investments accessible. However, ensure you select a standalone card with:

- Guaranteed Renewal: The insurer cannot cancel it just because you got sick.

- High Annual Limit: Minimum RM1,000,000 is the current standard.

- Cashless Admission: Ensure it has a strong panel hospital network for ease of entry.